Сайт мега даркнет megadarknetonion

Как зарегистрироваться на Mega? Неприятно, не правда ли? Мега лучшее решение для тех, кто решил расслабиться или устроить незабываемый карнавал эмоций, скрасить унылые будни и создать незабываемый праздник. Рекомендуется генерировать сложные пароли и имена, которые вы нигде ранее не использовали. Union, например ore или новое зеркало даркнет /, то вы увидите ненастоящий сайт, так как у Mega Url правильная доменная зона. Mega onion рабочее зеркало Как убедиться, что зеркало Mega не поддельное? Поскольку на Mega сайте все транзакции осуществляются в криптовалюте для обеспечения их анонимности, разработчики создали опцию обмена, где можно приобрести нужное количество монет. Для нас каждый клиент это прежде всего индивидуальность, мы идем ему на встречу. This is a priority мега площадка in the Russian-speaking darknet cluster. The Мега площадка makes it easy to purchase items that are prohibited for sale after Hydra liquidation. Мега официальный сайт защищен от утечек данных и DDoS-атак. Все проводимые на портале транзакции предельно безопасны и анонимны. Официальный сайт мега Даркнет Маркет и все зеркала Mega Onion. Узнайте как зайти на Мегу через Tor или без VPN браузера. Рабочие ссылки в сети Тор. Сайт мега даркнет, лучший маркет среди площадок России и СНГ. Перейдя по ссылке на сайт мега, вы получите доступ mega более чем.500 продавцов, с огромнейшим ассортиментом товара на любой вкус. Официальный сайт площадка Мега даркнет - актуальная ссылка на сайт мега. На площадке mega darknet вы получаете только провернные и качественные товары и услуги. Даркнет мега площадка. Удобый и безопасный сайт мега, анонимные покупки на сайте mega даркнет. Только провернные поставщики на мегадаркнет.

Сайт мега даркнет megadarknetonion - Mega darknet market mega dm

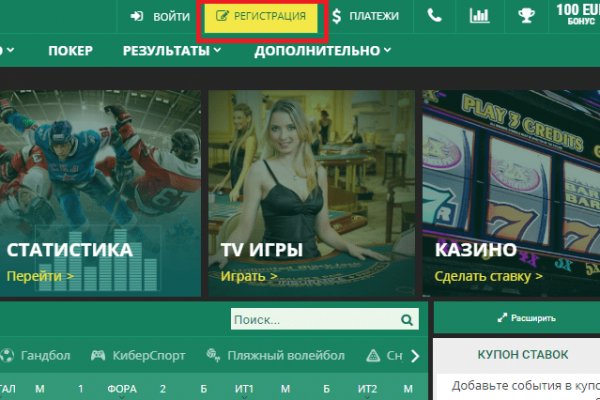

Даже если он будет выглядеть как настоящий, будьте бдительны, это может быть фейковая копия. Система рейтингов покупателей и продавцов (все рейтинги открыты для пользователей). Регистрация При регистрации учетной записи вам предстоит придумать логин, отображаемое имя и пароль. Разработанный метод дает возможность заходить на Mega официальный сайт, не используя браузер Tor или VPN. На нашем сайте всегда рабочая ссылки на Мега Даркнет. После входа на сайт по правильной ссылке, нужно выполнить новый этап это регистрация. Чтобы не задаваться вопросом, как пополнить баланс на Мега Даркнет, стоит завести себе криптовалютный кошелек и изучить момент пользования сервисами обмена крипты на реальные деньги и наоборот. Правильное названия Рабочие ссылки на Мегу Главный сайт Перейти на mega Официальное зеркало Зеркало Мега Альтернативное зеркало Мега вход Площадка Мега Даркнет mega это каталог с продавцами, маркетплейс магазинов с товарами специфического назначения. Еще одна прекрасная новость для пользователей. Залетайте пацаны, проверено! У нас вы отоваритесь за минуты. Лучше сохраните себе в закладки рабочие ссылки и пользуйтесь ими, меняя и освежая их по мере необходимости. Ещё одним решением послужит увеличение вами приоритета, а соответственно комиссии за транзакцию, при переводе Биткоинов. Видно число проведенных сделок в профиле. Это сделано для того, чтобы покупателю было максимально удобно искать и приобретать нужные товары. Согласно мнению аналитиков, оборот с 2019 года увеличился.3 миллионов долларов до 2 миллиардов в 2020 году. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Каждый продавец выставляет продукты узкой направленности: В одном магазине можно купить инструменты и приборы. Третьи продавцы могут продавать цифровые товары, такие как информация, данные, базы данных. Никогда не ищите ссылке в обычных браузерах, так как именно там больше всего мошенников. Переходя по ним, вы будете точно уверенны в том, что не угодите на фишинговый сайт. Также обещают исправить Qiwi, Юмани, Web Money, Pay Pal. Это даст возможность обойти блокировки и добиться максимальной конфиденциальности. Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Репутация При совершении сделки, тем не менее, могут возникать спорные ситуации. На сайте mega SB всегда можно найти актуальные ссылки и зеркала в большом количестве. Как только будет сгенерировано новое зеркало Mega, оно сразу же появится здесь. Оригинальное название mega, ошибочно называют: mego, мего, меджа, union. Стоит помнить внешний вид Мега Шопа, чтобы не попасть на фейки. Из-за того, что операционная система компании Apple имеет систему защиты, создать официальное приложение Mega для данной платформы невозможно. Это говорит о систематическом росте популярности сайта. Это защитит вашу учетную запись от взлома. Поисковики Настоятельно рекомендуется тщательно проверять ссылки, которые доступны в выдаче поисковой системы. Мы провели опрос и выяснили, чем же так привлекает сайт Мега клиентов: Возможность, не выходя из дома прибрести товар отличного качества; Быстрое реагирование на зая. Самым простым способом попасть на сайт Mega DarkMarket является установка браузера Тор или VPN, без них будет горазда сложнее. Onion/ ссылка на сайт.onion через ТОР на mega. Если и по прошествии этого временного отрезка деньги так и не поступили, задайте вопрос в службу технической поддержки. Оригинальный сайт: mega (через TOR browser) / (через Тор) / (онион браузер).Сборник настоящих, рабочих ссылок на сайт мега в Даркнете, чтобы вы через правильное, рабочее зеркало попали на официальный сайт Меги. Mega вход Как зайти на Мегу 1 Как зайти на мегу с компьютера. Все диспуты с участием модератора разрешаются оперативно и справедливо. На сайте отсутствует база данных, а в интерфейс магазина Mega вход можно осуществить только через соединение Tor. Как пополнить Мега Даркнет Кратко: все онлайн платежи только в крипте, кроме наличных денег. Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. Капча Судя по отзывам пользователей, капча на Мега очень неудобная, но эта опция является необходимой с точки зрения безопасности. Это всем привычный биткоин и два альтернативных варианта: XMR Монеро. Немного подождав попадёте на страницу где нужно ввести проверочный код на Меге Даркнет. Выбирая на магазине Мега Даркнет анонимные способы оплаты, типа Биткоин, вы дополнительно страхуете себя. Как выглядит рабочий сайт Mega Market Onion. Или она уже устарела и не работает, или вовсе фишинговая.

Выберите файлы или папку. З охочими купити наркотик зловмисники спілкуються зазвичай у Telegram. Эта акция была подкреплена международным сотрудничеством. Экспертизы на вещества, которые прошел Голунов, показали, что наркотиков в его организме не обнаружено. Будущий глава лейбла Elektra Records, а в то время музыкальный публицист. Доказательства обмана следует загружать непосредственно в чат диспута. Я сформировал своё определение андеграунда это то, что существует независимо от формации. Индастриал-группы первой волны британские Throbbing Gristle и Cabaret Voltaire, а также немецкая Einsturzende Neubauten организовывали на своих концертах провокационные перформансы, содержащие элементы членовредительства и садомазохизма наряду с использованием тоталитаристских символов и образов 143. Как долго ты с ним живешь, сколько из них принимаешь терапию и как ты узнала о ВИЧ? Гидрасек: инструкция, показания и противопоказания, отзывы, цены и заказ в аптеках, способ. Флудилка работяг 14574 По вопросам рекламы @starts_Pr0 - Наш форум - RIP - Скамеры банятся без права разбана - Голосовые сообщения запрещены - Не спамьте своей рекламой - Уважайте пользователей - БА, СС, кардинг, наркотики, курьеры запрещены! Трудовая деятельность граждан, проходящих альтернативную гражданскую службу, регулируется Трудовым кодексом Российской Федерации с учетом особенностей, предусмотренных настоящим Федеральным законом. На компьютере откройте страницу. Программа поддерживает более 30 видов запросов, среди них есть POP3, smtp, FTP, cisco, ICQ, даркнет VNC, telnet. И довольна ли ты вообще тем, как организована ЗПТ в твоем городе, на твоем сайте? Gorech10 2 дня назад Я конечно редко пользуюсь сайтами, обычно беру с рук, но когда нет варианта сойдет и это. Но из-за технических сложностей, появляющихся в ходе диспута, иногда загрузить фотографию очень сложно или невозможно. В любом случае у вас все получится, главное найти правильную ссылку на Гидру. Choose language Change value omgomg ОМГ даркнет OMG OMG ОМГ ОМГ ссылка omgomg сайт сайт omgomg OMG ОМГ omgomg даркнет площадка ОМГ ОМГ ОМГ сайт сайт omgomциальный. Статьи на разные темы связанные с альтернативной гражданской службой Пчелинцев. Огромное Вам спасибо! Обязательный отзыв покупателя после совершения сделки. Состояние просто ужасное и не у меня одной. Настройки Google Диска можно изменить только на компьютере. Мы работаем только с магнитом, чтобы съём был максимально быстрым и легким для Вас! Что делать в такой ситуации? A couple of minutes and I have all the goods, so follow the ссылка omg. Путешествуя поездом, не соглашайтесь на «передачи» в другой город от незнакомых людей. The Manics' lyrics were something special (англ.). 100 лучших постсоветских альбомов за 30 лет: 10051-е места, от Земфиры до «Мумий Тролля» (рус.). 30 лет. Альтернативный рок в ссср и России Альтернативный рок в России начал формироваться в конце 1980-х годов. И все это закончилось тем, что я уже четвертый год на ЗПТ. У меня есть мама, папа. Постоянно работая над функционалом и стабильностью, качеством и товарами, что бы полки ломились. Спустя час после первой группы правоохранителей на место прибыл и патрульный новой столичной полиции. Музыканты этого сообщества внесли весомый вклад в эксперименты со звучанием постпанка. На нашем сайте есть все, что вам нужно для получения хорошего настроения. По словам активистов, проблема нелегального оборота наркосодержащих препаратов имеет огромные масштабы в столице. Согласно мнению аналитиков, оборот с 2019 года увеличился.3 миллионов долларов до 2 миллиардов в 2020 году. Синтаксис параметров в этом случае будет выглядеть так: адрес_страницы:имя_поля_логинаuser имя_поля_пароляpass произвольное_полезначение:строка_при_неудачном_входе Строка запуска: hydra -l user -P /john. В операции против «Гидры» также принимали участие сотрудники. Я пошла и сдала кровь на все анализы. 8 июл. А что тебе мешает поменять схему? Ученик (95 на голосовании 1 неделю назад Сайт Mega, дайте пожалуйста официальную ссылку на Мегу или зеркала onion чтобы. Сохраняем жизни и здоровье людей, употребляющих наркотики.